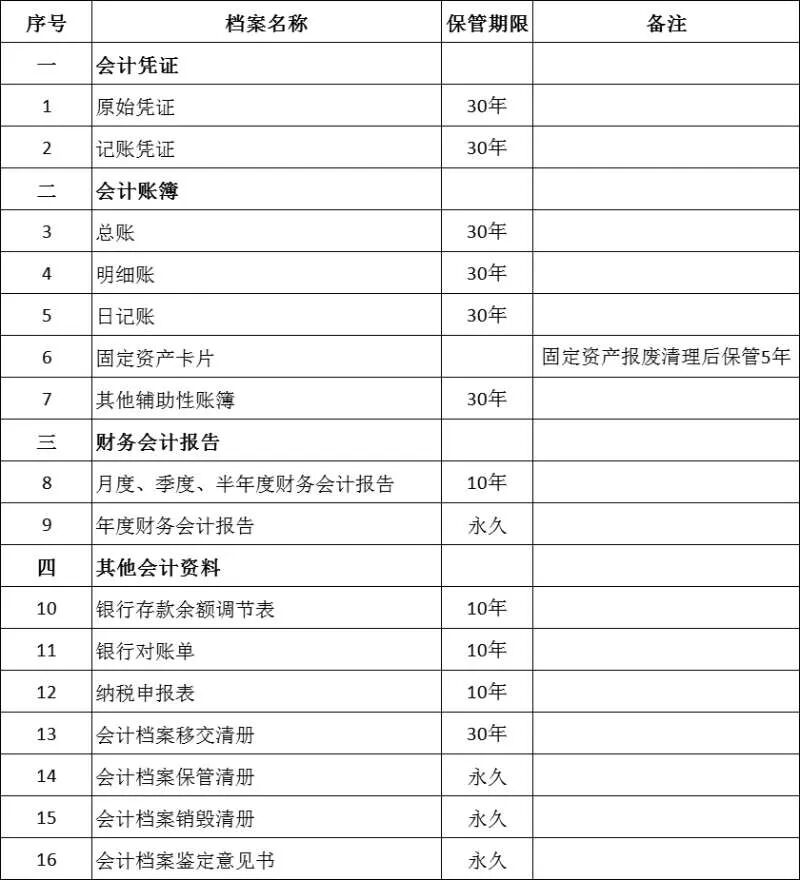

隨著公司的業務發展變化,辦公地址往往也會頻繁變更,3年一小變,5年一大變幾乎是很多企業的常態。每次搬家,各類檔案資料也必須一同轉運。公司經營時間越長,檔案資料越多,每次轉運及日常保管都給企業帶來很大的困擾。這其中,會計檔案又顯得尤為突出。總有讀者咨詢,會計檔案需要保管多久?如果銷毀的話,需要履行哪些審批手續?一、各類會計檔案保管期限按照2015年財政部和國家檔案局頒布的《會計檔案管理辦法》(中華人民共和國財政部 國家檔案局令第79號,以下簡稱“79號令”)的規定,企業的會計檔案保管年限按下表所列示的期限進行保管。企業和其他組織會計檔案保管期限表

對于上表中所列示的會計檔案保管,除了保管期限外,實務中需要關注以下幾個問題:1、保管期限如何計算。上述表中所列示的會計檔案的保管期限,從會計年度終了后的第一天算起。如2021年的會計檔案,從2022年1月1日開始計算保管年限。2、企業如何確定保管期限。上述會計檔案保管期限為最低保管期限,企業可以在此基礎上增加年限。3、企業自定義的會計檔案如何確定保管期限。企業會計檔案的具體名稱如有同上表所列檔案名稱不相符的,應當(就是必須)比照類似檔案的保管期限確定具體年限。4、企業合并,會計檔案如何保管。企業發生合并,合并后原各單位解散或者一方存續其他方解散的,原各單位的會計檔案應當由合并后的單位統一保管。單位合并后原各單位仍存續的,其會計檔案仍應當由原各單位保管。5、企業分立,會計檔案如何保管。企業發生分立,分立后原單位存續的,其會計檔案應當由分立后的存續方統一保管,其他方可以查閱、復制與其業務相關的會計檔案。分立后原單位解散的,其會計檔案應當經各方協商后由其中一方代管或按照國家檔案管理的有關規定處置,各方可以查閱、復制與其業務相關的會計檔案。6、企業注銷,會計檔案如何保管。79號令規定,單位因撤銷、解散、破產或其他原因而終止的,在終止或辦理注銷登記手續之前形成的會計檔案,按照國家檔案管理的有關規定處置。這個有關規定是如何規定的呢?按照《中華人民共和國檔案法》的規定,企業發生撤銷、合并等情形時,應當按照規定向有關單位或者檔案館移交檔案。對于絕大部分民營企業而言,注銷后向政府部門移交檔案基本不切實際。那企業所有者能自行銷毀嗎?

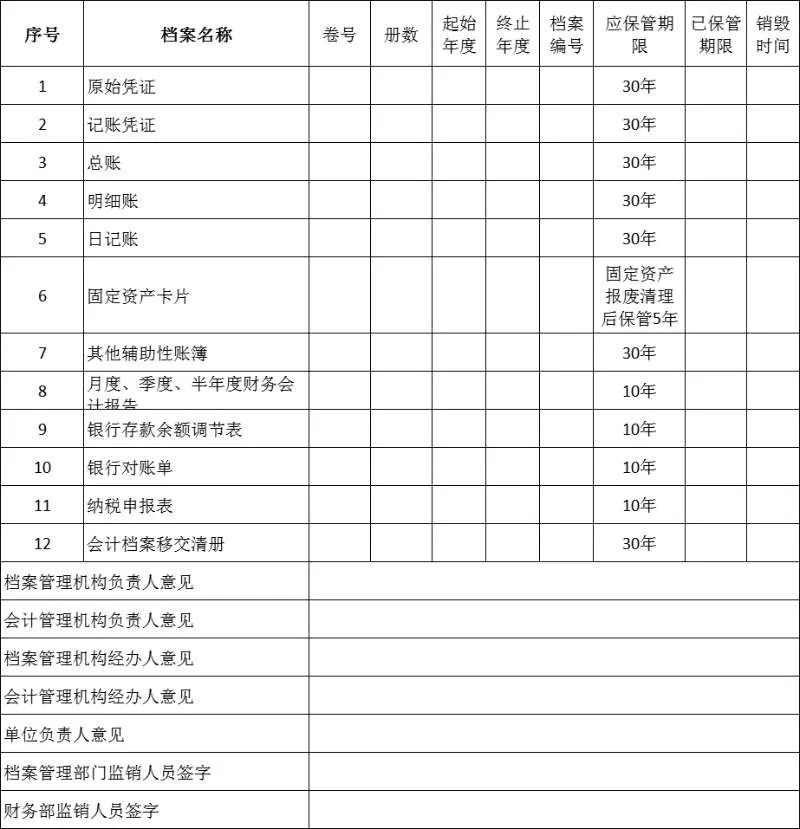

保險起見,建議參考原《會計檔案管理辦法》(財會字〔1998〕32號)的規定,在會計檔案尚未到達保管期限時,由財產所有者(股東)代管。待保管期限屆滿時,按下列銷毀程序處理。二、會計檔案銷毀程序(一)檔案鑒定按照79號令的要求,會計檔案保管到期后,公司應成立檔案鑒定小組,對檔案進行鑒定。鑒定小組由檔案管理部門(財務部或行政部)牽頭,成員包括公司會計、審計、紀檢監察等機構或人員(注:只需公司內部人員即可,不需外請中介機構協助)。鑒定小組鑒定后,形成鑒定意見并由鑒定人員簽字,確無保存價值的會計檔案,可以銷毀(注:不需向政府部門報備或審批)。保管期滿但未結清的債權債務會計憑證和涉及其他未了事項的會計憑證不得銷毀,紙質會計檔案應當單獨抽出立卷,電子會計檔案單獨轉存,保管到未了事項完結時為止。(二)會計檔案銷毀程序1、編制銷毀清冊。檔案管理部門編制會計檔案銷毀清冊,列明擬銷毀會計檔案的名稱、卷號、冊數、起止年度、檔案編號、應保管期限、已保管期限和銷毀時間等內容。2、簽署意見。單位負責人、檔案管理機構負責人、會計管理機構負責人、檔案管理機構經辦人、會計管理機構經辦人在會計檔案銷毀清冊上簽署意見。3、現場監銷。單位檔案管理機構負責組織會計檔案銷毀工作,并與會計管理機構共同派員監銷(如焚燒、粉碎或打成紙漿)。監銷人在會計檔案銷毀前,應當按照會計檔案銷毀清冊所列內容進行清點核對;在會計檔案銷毀后,應當在會計檔案銷毀清冊上簽名。《會計檔案銷毀清冊》沒有統一的格式,有需要的企業可以參考下面的樣表進行增減。

會計檔案銷毀清冊(樣表)

三、故意銷毀賬簿的法律責任

如果不到保管期限而銷毀賬簿,會有什么后果呢?通常來說,如果企業沒有任何問題,不會有什么后果。但如果出現了一些經濟和稅收問題,有關部門檢查的時候,發現賬簿保管未到期而已經被銷毀,可能會涉及以下法律責任。

2022年4月29日,最高人民檢察院、公安部4月29日聯合發布修訂后的《關于公安機關管轄的刑事案件立案追訴標準的規定(二)》,修訂后的《立案追訴標準(二)》對公安機關管轄的78種經濟犯罪案件立案追訴標準予以進一步明確規定,該標準自2022年5月15日起實施。其中第八條是關于故意銷毀賬簿的條款。

第八條 〔隱匿、故意銷毀會計憑證、會計帳簿、財務會計報告案(刑法第一百六十二條之一)〕隱匿或者故意銷毀依法應當保存的會計憑證、會計帳簿、財務會計報告,涉嫌下列情形之一的,應予立案追訴: (一)隱匿、故意銷毀的會計憑證、會計帳簿、財務會計報告涉及金額在五十萬元以上的; (二)依法應當向監察機關、司法機關、行政機關、有關主管部門等提供而隱匿、故意銷毀或者拒不交出會計憑證、會計帳簿、財務會計報告的;(三)其他情節嚴重的情形。

With the business development and change of the company, the office address often changes frequently. It is almost normal for many enterprises to change once every three years and once every five years. Every time you move, all kinds of archives must be transferred together. The longer the company operates, the more archives, and each transfer and daily storage will bring great trouble to the enterprise. Among them, accounting archives are particularly prominent. There are always readers' inquiries. How long do accounting files need to be kept? If it is destroyed, what approval procedures need to be performed? 1、 The retention period of various accounting archives shall be in accordance with the provisions of the measures for the management of accounting archives issued by the Ministry of Finance and the State Archives Administration in 2015 (Order No. 79 of the Ministry of Finance and the State Archives Administration of the people's Republic of China, hereinafter referred to as "order No. 79"), and the retention period of the enterprise's accounting archives shall be the period listed in the following table. Retention period of accounting archives of enterprises and other organizations

picture

For the custody of accounting archives listed in the above table, in addition to the custody period, the following issues need to be paid attention to in practice: 1. How to calculate the custody period. The retention period of the accounting files listed in the above table shall be calculated from the first day after the end of the accounting year. For example, the retention period of accounting archives in 2021 shall be calculated from January 1, 2022. 2. How the enterprise determines the storage period. The above-mentioned retention period of accounting archives is the minimum retention period, and the enterprise can increase the retention period on this basis. 3. How to determine the retention period of an enterprise's user-defined accounting file. If the specific names of enterprise accounting archives are inconsistent with those listed in the above table, the specific years shall be (or must be) determined by referring to the retention period of similar archives. 4. How to keep accounting files for business combinations. In the event of a merger of enterprises, where the original units are dissolved after the merger or one of the surviving parties is dissolved, the accounting files of the original units shall be kept by the merged units in a unified manner. If the original units still exist after the merger, their accounting files shall still be kept by the original units. 5. How to keep accounting files when enterprises are divided. Where an enterprise is divided and the original unit continues to exist after the division, its accounting files shall be kept by the surviving party after the division, and other parties may consult and copy the accounting files related to their business. If the original unit is dissolved after the division, its accounting files shall be managed by one of the parties after consultation or disposed of in accordance with the relevant provisions of the state archives management. Each party may consult and copy the accounting files related to its business. 6. How to keep accounting files when an enterprise is cancelled. Decree No. 79 stipulates that if the unit is terminated due to cancellation, dissolution, bankruptcy or other reasons, the accounting files formed before the termination or cancellation of registration procedures shall be disposed of in accordance with the relevant provisions of the national archives management. How is this relevant regulation stipulated? In accordance with the provisions of the archives law of the people's Republic of China, when an enterprise is dissolved or merged, it shall hand over the archives to the relevant units or archives repositories in accordance with the provisions. For the vast majority of private enterprises, it is basically unrealistic to hand over archives to government departments after cancellation. Can the business owner destroy it by himself?

For the sake of insurance, it is recommended to refer to the provisions of the original measures for the management of accounting archives (CAI Kuai Zi [1998] No. 32), and the property owner (shareholder) shall take care of the accounting archives when they have not reached the storage period. When the storage period expires, the following destruction procedures shall be followed. 2、 Procedures for destruction of accounting archives (I) archives appraisal according to the requirements of order 79, after the accounting archives are kept for a period of time, the company shall establish an archives appraisal team to appraise the archives. The identification team is led by the archives management department (financial department or administrative department), and its members include the company's accounting, auditing, discipline inspection and supervision institutions or personnel (Note: only internal personnel of the company are required, and no external intermediary agencies are required to assist). After the appraisal by the appraisal team, the appraisal opinions shall be formed and signed by the appraisers. The accounting archives that have no preservation value can be destroyed (Note: it is not necessary to report to the government department for filing or approval). The accounting vouchers for creditor's rights and debts that have expired but have not been settled and the accounting vouchers involving other outstanding matters shall not be destroyed. The paper accounting archives shall be taken out and filed separately, and the electronic accounting archives shall be transferred and stored separately until the outstanding matters are completed. (2) Destruction procedure of accounting archives 1. Prepare destruction list. The archives management department shall prepare a detailed list of the destruction of accounting archives, listing the name, volume number, number of copies, starting and ending year, file number, retention period, retention period and destruction time of the accounting archives to be destroyed. 2. Sign comments. The person in charge of the unit, the person in charge of the archives management institution, the person in charge of the accounting management institution, the person in charge of the archives management institution and the person in charge of the accounting management institution shall sign their opinions on the list of destruction of accounting archives. 3. On site sales supervision. The unit archives management organization is responsible for organizing the destruction of accounting archives, and jointly sending personnel with the accounting management organization to supervise the sale (such as burning, crushing or pulping). Before the destruction of accounting archives, the sales supervisor shall count and verify the contents listed in the detailed list of destruction of accounting archives; After the destruction of accounting archives, the detailed list of destruction of accounting archives shall be signed. There is no unified format for the detailed list of destruction of accounting archives. Enterprises in need can refer to the following sample table for additions and deletions.

Destruction list of accounting archives (sample table)

picture

3、 Legal liability for intentional destruction of account books

What will happen if the account books are destroyed before the expiration date? Generally speaking, if the enterprise has no problems, there will be no consequences. However, if there are some economic and tax problems, and the relevant departments find that the account books have been destroyed before their expiration, the following legal liabilities may be involved.

On April 29, 2022, the Supreme People's Procuratorate and the Ministry of Public Security jointly issued the revised provisions on the standards for filing and prosecution of criminal cases under the jurisdiction of public security organs (II). The revised standards for filing and prosecution (II) further defined the standards for filing and prosecution of 78 economic crime cases under the jurisdiction of public security organs. The standards will be implemented from May 15, 2022. Article 8 is about the intentional destruction of account books.

Article 8 Whoever conceals or intentionally destroys accounting vouchers, accounting books and financial accounting reports that should be kept according to law shall be prosecuted if he is suspected of any of the following circumstances: (1) concealing or intentionally destroying accounting vouchers, accounting books The amount involved in the financial accounting report is more than 500000 yuan; (2) Concealing, deliberately destroying or refusing to hand over accounting vouchers, account books or financial and accounting reports that should be provided to supervisory organs, judicial organs, administrative organs or relevant competent departments according to law; (3) Other serious circumstances.

?

免責聲明:以上內容轉自其它媒體,相關信息僅為傳播更多信息,與本站立場無關。月盛科技不保證該信息(包含但不限于文字、視頻、音頻、數據及圖表)全部或者部分內容的準確性、真實性、完整性、有效性、及時性、原創性等,如有侵權請聯系400-716-8870。